ACA Alerts

Alerts Regarding the Affordable Care Act

The requirements for the Affordable Care Act are constantly changing. Referencing this page will help you stay current and remain compliant. Alerts are posted to this page when the IRS releases new information regarding the ACA and its ever-changing regulations. In addition to this helpful tool, we offer an array of services to help you through the compliance maze.

May, 2017

Update on recent subsidy eligibility notice activity in State-Based Exchange Marketplaces

If you conduct business in California or Vermont, or have employees living in those states, you may begin to see subsidy notices in the mail.

California’s Marketplace, Covered California and Vermont’s Marketplace, Vermont Health Connect, have recently sent notices to employers notifying them of employees who are enrolled in those state based exchanges with premium subsidy assistance. Employees enrolled in exchange coverage with premium assistance, may trigger a penalty to their employer under the employer mandate provision of the Affordable Care Act.

Employers can appeal the decision to grant premium subsidy assistance to employees enrolled in exchange coverage but need to do so in the stated time period allowed on the notice.

California and Vermont join three other states, Minnesota, Connecticut and Washington, who have also been sending notices to employers since open enrollment in the state exchanges ended in January 2017.

March 27, 2017

IRS Notice 2016-70

EXTENSION OF DUE DATE FOR FURNISHING STATEMENTS AND OF GOOD-FAITH TRANSITION RELIEF UNDER I.R.C. SECTIONS 6721 AND 6722 FOR REPORTING REQUIRED BY I.R.C. SECTIONS 6055 AND 6056 FOR 2016

PURPOSE

This notice extends the due date for certain 2016 information-reporting requirements for insurers, self-insuring employers, and certain other providers of minimum essential coverage under section 6055 of the Internal Revenue Code (Code) and for applicable large employers under section 6056 of the Code. Specifically, this notice extends the due date for furnishing to individuals the 2016 Form 1095-B, Health Coverage, and the 2016 Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, from January 31, 2017, to March 2, 2017. This notice also extends good-faith transition relief from section 6721 and 6722 penalties to the 2016 information-reporting requirements under sections 6055 and 6056.

BACKGROUND

Sections 6055 and 6056 were added to the Code by sections 1502 and 1514 of the Patient Protection and Affordable Care Act (ACA), enacted March 23, 2010, Pub. L. No. 111-148, 124 Stat. 119, 250, 256. Section 6055 requires health insurance issuers, self-insuring employers, government agencies, and other providers of minimum essential coverage to file and furnish annual information returns and statements regarding coverage provided. Section 6056 requires applicable large employers (generally those with 50 or more full-time employees, including full-time equivalent employees, in the previous year) to file and furnish annual information returns and statements relating to the health insurance, if any, that the employer offers to its full-time employees. Section 6056 was amended by sections 10106(g) and 10108(j) of the ACA and was further amended by section 1858(b)(5) of the Department of Defense and Full-Year Continuing Appropriations Act, 2011, Pub. L. No. 112-10, 125 Stat. 38, 169. Section 36B, which was added to the Code by section 1401 of the ACA, provides a premium tax credit for eligible individuals who enroll in coverage through a Health Insurance Marketplace. Section 5000A, which was added to the Code by section 1501(b) of the ACA, generally provides that individuals must have minimum essential coverage, qualify for an exemption from the minimum essential coverage requirement, or make an individual shared responsibility payment when they file their federal income tax return.

Section 6721 of the Code imposes a penalty for failing to timely file an information return or for filing an incorrect or incomplete information return. Section 6722 of the Code imposes a penalty for failing to timely furnish an information statement or for furnishing an incorrect or incomplete information statement. Section 6721 and 6722 penalties are imposed with regard to information returns and statements listed in section 6724(d) of the Code, which includes those required by sections 6055 and 6056.

Final regulations, published on March 10, 2014, relating to the reporting requirements under sections 6055 and 6056, specify the deadlines for information reporting required by those sections. See Information Reporting of Minimum Essential Coverage, T.D. 9660, 2014-13 I.R.B. 842; Information Reporting by Applicable Large Employers on Health Insurance Coverage Offered Under Employer-Sponsored Plans, T.D. 9661, 2014-13 I.R.B. 855. The regulations under section 6055 provide that every person that provides minimum essential coverage to an individual during a calendar year must file with the Internal Revenue Service (Service) an information return and a transmittal on or before the following February 28 (March 31 if filed electronically) and must furnish to the responsible individual identified on the return a written statement on or before January 31 following the calendar year to which the statement relates. The Service has designated Form 1094-B, Transmittal of Health Coverage Information Returns, and Form 1095-B to meet the requirements of the section 6055 regulations.

The regulations under section 6056 require every applicable large employer or a member of an aggregated group that is determined to be an applicable large employer (ALE member) to file with the Service an information return and a transmittal on or before February 28 (March 31 if filed electronically) of the year following the calendar year to which it relates and to furnish to full-time employees a written statement on or before January 31 following the calendar year to which the statement relates. The Service has designated Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, and Form 1095-C to meet the requirements of the section 6056 regulations.

The regulations under sections 6055 and 6056 allow the Service to grant extensions of time of up to 30 days to furnish Forms 1095-B and 1095-C for good cause shown. Treas. Reg. §§ 1.6055-1(g)(4)(i)(B)(1), 301.6056-1(g)(1)(ii)(A). In addition, filers of Forms 1094-B, 1095-B, 1094-C, and 1095-C may receive an automatic 30-day extension of time to file such forms with the Service by submitting Form 8809, Application for Extension of Time To File Information Returns, on or before the due date for filing those forms. Treas. Reg. § 1.6081-1; Temp. Treas. Reg. § 1.6081-8T. Under certain hardship conditions, filers who submit Form 8809 before the automatic 30-day extension period expires and explain in detail why the additional time is needed may also receive an additional 30-day extension of time to file Forms 1094-B, 1095-B, 1094-C, and 1095-C with the Service.

The preambles to the section 6055 and 6056 regulations (T.D. 9660, 2014-13 I.R.B. 842; T.D. 9661, 2014-13 I.R.B. 855) provided that, for reporting of 2015 offers and coverage, the Service would not impose penalties under sections 6721 and 6722 on reporting entities that can show that they made good-faith efforts to comply with the information-reporting requirements. This relief applied only to furnishing and filing incorrect or incomplete information reported on a statement or return, and not to a failure to timely furnish or file a statement or return. Notice 2015-87, 2015-52 I.R.B. 889, reiterated that relief, and Notice 2015-68, 2015-41 I.R.B. 547, provided additional information about that relief with regard to reporting under section 6055. The preambles also noted the general rule that, under section 6724 and the related regulations, the section 6721 and 6722 penalties may be waived if a failure to timely furnish or file a statement or return is due to reasonable cause. This requires the reporting entity to demonstrate that it acted in a responsible manner, and that the failure was due to significant mitigating factors or events beyond the reporting entity’s control. In addition, proposed regulations under section 6055 published on August 2, 2016 proposed additional rules for reporting. 81 Fed. Reg. 50671.

Notice 2016-4, 2016-3 I.R.B. 279, extended the due dates for the 2015 information-reporting requirements under sections 6055 and 6056 (both those for furnishing to individuals and for filing with the Service). In particular, the notice provided that the furnishing deadline for the 2015 Forms 1095-B and 1095-C was extended from February 1, 2016, to March 31, 2016, and that the filing deadline for the 2015 Forms 1094-B, 1095-B, 1094-C, and 1095-C was extended from February 29, 2016, to May 31, 2016, if not filing electronically, and from March 31, 2016, to June 30, 2016, if filing electronically. In addition, the notice provided that the provisions regarding automatic and permissive 30-day extensions of time for filing information returns and permissive extensions of time (of up to 30 days) for furnishing statements would not apply to the extended due dates.

TRANSITION RELIEF

A. Extension of Due Date for Furnishing to Individuals under Sections 6055 and 6056 for 2016

Following consultation with stakeholders, the Department of the Treasury (Treasury) and the Service have determined that a substantial number of employers, insurers, and other providers of minimum essential coverage need additional time beyond the January 31, 2017, due date to gather and analyze the information and prepare the 2016 Forms 1095-B and 1095-C to be furnished to individuals. Accordingly, this notice extends by 30 days the due date for furnishing the 2016 Form 1095-B and the 2016 Form 1095-C, from January 31, 2017, to March 2, 2017. In view of this automatic extension, the provisions under Treas. Reg. §§ 1.6055-1(g)(4)(i)(B)(1) and 301.6056-1(g)(1)(ii)(A) allowing the Service to grant extensions of time of up to 30 days to furnish Forms 1095-B and 1095-C will not apply to the extended due date. Notwithstanding the extensions provided in this notice, employers and other coverage providers are encouraged to furnish 2016 statements as soon as they are able.

Treasury and the Service have determined that there is no similar need for additional time for employers, insurers, and other providers of minimum essential coverage to file with the Service the 2016 Forms 1094-B, 1095-B, 1094-C, and 1095-C. Therefore, this notice does not extend the due date for filing with the Service the 2016 Forms 1094-B, 1095-B, 1094-C, or 1095-C, which remains February 28, 2017, if not filing electronically, or March 31, 2017, if filing electronically. However, this notice does not affect the provisions regarding automatic extensions of time for filing information returns, which remain available under the normal rules by submitting a Form 8809. See Treas. Reg. § 1.6081-1; Temp. Treas. Reg. § 1.6081-8T. It also does not affect the provisions regarding additional extensions of time to file.

Employers or other coverage providers that do not comply with the due dates for furnishing Forms 1095-B and 1095-C (as extended under the rules described above) or for filing Forms 1094-B, 1095-B, 1094-C, or 1095-C are subject to penalties under section 6722 or 6721 for failure to timely furnish and file, respectively. However, employers and other coverage providers that do not meet the relevant due dates should still furnish and file. The Service will take such furnishing and filing into consideration when determining whether to abate penalties for reasonable cause.

The extension of the due date provided by this notice applies only to section 6055 and 6056 information statements for calendar year 2016 furnished in 2017 and does not require the submission of any request or other documentation to the Service. Because the 30-day extension of the due date to furnish granted in this notice applies automatically and is as generous as the permissive 30-day extensions of time to furnish 2016 information statements under sections 6055 and 6056 that have already been requested by some reporting entities in submissions to the Service, the Service will not formally respond to such requests.

Because of the extension granted under this notice, some individual taxpayers may not receive a Form 1095-B or Form 1095-C by the time they are ready to file their 2016 tax return. Taxpayers may rely on other information received from their employer or other coverage provider for purposes of filing their returns, including determining eligibility for the premium tax credit under section 36B and confirming that they had minimum essential coverage for purposes of sections 36B and 5000A. Taxpayers do not need to wait to receive Forms 1095-B and 1095-C before filing their returns. Individuals need not send the information relied upon to the Service when filing their returns but should keep it with their tax records.

B. Extension of Good Faith Transition Relief from Section 6721 and 6722 Penalties for 2016

In implementing new information-reporting requirements, short-term relief from penalties frequently is provided. This relief recognizes the challenges involved in developing new procedures and systems to accurately collect and report information in compliance with new reporting requirements. The preambles to the section 6055 and 6056 regulations provided transition relief from penalties under sections 6721 and 6722 to reporting entities that can show that they made good-faith efforts to comply with the information-reporting requirements for 2015. This relief applied only to incorrect and incomplete information reported on the statement or return and not to a failure to timely furnish or file a statement or return. Following consultation with stakeholders, Treasury and the Service have determined that this relief is appropriate for the information-reporting requirements under sections 6055 and 6056 for 2016 also.

Specifically, this notice extends transition relief from penalties under sections 6721 and 6722 to reporting entities that can show that they have made good-faith efforts to comply with the information-reporting requirements under sections 6055 and 6056 for 2016 (both for furnishing to individuals and for filing with the Service) for incorrect or incomplete information reported on the return or statement. This relief applies to missing and inaccurate taxpayer identification numbers and dates of birth, as well as other information required on the return or statement. No relief is provided in the case of reporting entities that do not make a good-faith effort to comply with the regulations or that fail to file an information return or furnish a statement by the due dates (as extended under the rules described above). In determining good faith, the Service will take into account whether an employer or other coverage provider made reasonable efforts to prepare for reporting the required information to the Service and furnishing it to employees and covered individuals, such as gathering and transmitting the necessary data to an agent to prepare the data for submission to the Service, or testing its ability to transmit information to the Service. In addition, the Service will take into account the extent to which the employer or other coverage provider is taking steps to ensure that it will be able to comply with the reporting requirements for 2017.

C. Future Years

The extension of time for furnishing information statements under sections 6055 and 6056 for 2016 provided in this notice has no effect on these information-reporting provisions for other years or on the effective date or application of other ACA provisions. Treasury and the Service do not anticipate extending this transition relief – either with respect to the due dates or with respect to good faith relief from section 6721 and 6722 penalties – to reporting for 2017.

January 23, 2017

Important Notice: Trump Signs Executive Order, ACA Legislation Remains Unchanged

President Trump signed an executive order on Friday night confirming the Administration’s intent to repeal the Affordable Care Act and directing government agencies to “ease the burden” of ACA in the meantime. The full text of the executive order can be found here, but a few key points are as follows:

- Executive orders do not directly impact policy; ACA legislation remains unchanged.

- Moreover, the executive order explicitly states in Section 5 that the heads of agencies must comply with applicable laws in considering or promulgating revisions to existing regulations.

- The Department of Health and Human Services and the IRS have not yet issued any new guidance in response to the executive order

- Employers are omitted in the executive order and are not listed as one of the stakeholder groups that agencies are being encouraged to have leniency on.

Put simply, this action does not have material impact on the legislation or employers at this time.

Thus, the executive order does not relieve employers from the obligations to furnish statements to employees and file information returns with the IRS. Form 1095-C statements must be distributed to employees by March 2, 2017, and Forms 1094-C and 1095-C must be filed with the IRS by March 31, 2017. Employers should continue their efforts to comply with the legislation and meet applicable deadlines to avoid penalties. ACACS strongly encourages all customers to continue moving forward and remain focused on meeting upcoming reporting deadlines.

January 20, 2017

What are the implications of IRS Letter 5699?

You may have heard that the IRS recently issued Letter 5699 to request missing 2015 Affordable Care Act (ACA) reporting from employers. But, do you understand what that could mean for you in the near future?

Here’s what this letter may indicate:

1. The IRS is preparing to assess ACA fines. It is clear that the IRS is monitoring non-compliance and has dedicated tax compliance officers handling this process. Fines for forms left intentionally unfiled could reach $530/form with no maximum penalty limit.

2. Now is the time to file for tax year 2015 if you have not done so. While you may incur a penalty for filing late, it may be possible to reduce your penalty from $530 per form to $260 per form for those not already filed.

3. It is important to prepare and file your 2016 returns properly. Employers must file with the IRS by March 31 to avoid penalties.

December 8, 2016

Tax Exempt & Government Entities

Employers & Health Coverage Providers: You Have More Time in 2017 to Provide Information Forms to Covered Individuals

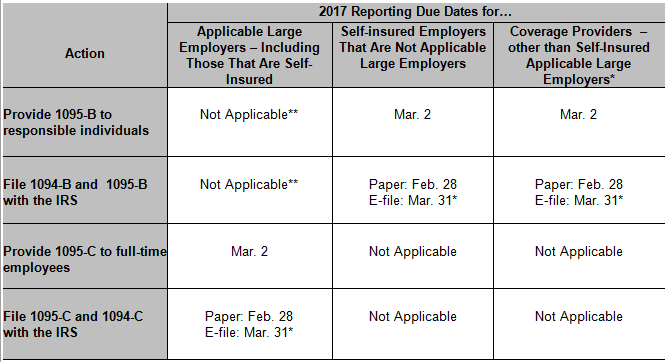

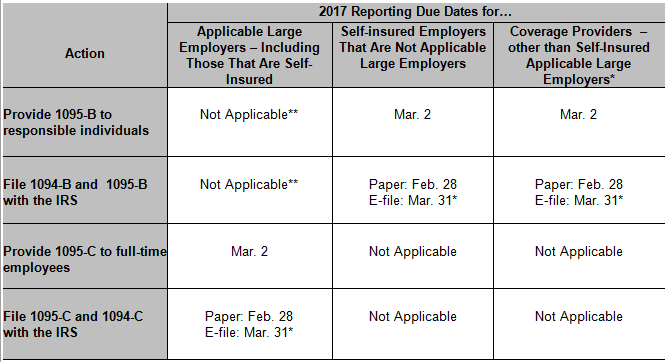

The IRS extended the 2017 due date for employers and coverage providers to furnish information statements to individuals. The due dates to file those returns with the IRS are not extended. This chart can help you understand the upcoming deadlines.

* If you file 250 or more Forms 1095-B or Forms 1095-C, you must electronically file them with the IRS. Electronically filing ACA information returns requires an application process separate from other electronic filing systems. Additional information about electronic filing of ACA Information Returns is on the Affordable Care Act Information Reporting (AIR) Program page on IRS.gov and in Publications 5164 and 5165.

** Applicable large employers that provide employer-sponsored self-insured health coverage to non-employees may use either Forms 1095-B or Form 1095-C to report coverage for those individuals and other family members.

This chart applies only for reporting in 2017 for coverage in 2016.

See IRS Notice 2016-70 for more information.

November 18, 2016

IRS Tax Tips Issue Number HCTT 2016-70

ACA Reporting Requirements

On Friday afternoon November 18, 2016 the IRS released notice 2016-70 regarding ACA Reporting Requirements.

1095 Distribution to Employees Extended to March 2, 2017

The notice extended the due date for ACA 1095-B and 1095-C Reporting from January 31, 2017 to March 2, 2017. The new date extends the timing for an employer to distribute forms 1095-B and 1095-C to their employees.

1094 Filing Deadline Remains March 31, 2017

The notice does not extend the IRS filing date for 1094 and 1095 filing with the IRS which is March 31, 2017.

Good Faith Reporting Extended for 2016

The IRS Notice also extends the transitional good-faith relief from penalties for 2016 reporting requirements. Under the good-faith standard the IRS will not assess a penalty for incomplete or incorrect information as long as the forms are filed on time and the employer can show that they have completed the forms in good-faith.

ACACS, Inc. Continues 1095 Reporting Process

While the extensions provide additional time for employers to distribute forms ACACS, Inc. will continue to move forward in completing 2016 IRS Reporting.

May 11, 2016

IRS Tax Tips Issue Number HCTT 2016-50

Why Employers Need to Count Employees

It’s important to know how many full-time employees you have because two provisions of the Affordable Care Act – employer shared responsibility and employer information reporting for offers of minimum essential coverage – apply only to applicable large employers. Employers average the number of their full-time employees, including full-time equivalents, for the months from the previous year to see whether they are considered an applicable large employer.

Whether your organization is an ALE for a particular calendar year depends on the size of your workforce in the preceding calendar year. To be an ALE, you must have had an average of at least 50 full-time employees – including full-time-equivalent employees – during the preceding calendar year. So, for example, you will use information about the size of your workforce during 2016 to determine if your organization is an ALE for 2017.

In general:

- A full-time employee is an employee who is employed on average, per month, at least 30 hours of service per week, or at least 130 hours of service in a calendar month.

- A full-time equivalent employee is a combination of employees, each of whom individually is not a full-time employee, but who, in combination, are equivalent to a full-time employee.

- An aggregated group is commonly owned or otherwise related or affiliated employers, which must combine their employees to determine their workforce size.

There are many additional rules on determining who is a full-time employee, including what counts as hours of service.

For more information, see the Information Reporting by Applicable Large Employers and the Employer Shared Responsibility Provisions pages on IRS.gov/aca.

February 10, 2016

IRS Tax Tips Issue Number HCTT 2015-17

ACA and Employers: How Seasonal Workers Affect Your ALE Status

When determining if your organization is an applicable large employer – which is also known as an ALE – you must measure your workforce by counting all your employees. However, there is an exception for seasonal workers.

If an employer’s workforce exceeds 50 full-time employees for 120 days or fewer during a calendar year, and the employees in excess of 50 who were employed during that period of no more than 120 days were seasonal workers, the employer is not considered an applicable large employer.

A seasonal worker for this purpose is an employee who performs labor or services on a seasonal basis. For example, retail workers employed exclusively during holiday seasons are seasonal workers.

The terms seasonal worker and seasonal employee are both used in the employer shared responsibility provisions, but in two different contexts. Only the term seasonal worker is relevant for determining whether an employer is an applicable large employer subject to the employer shared responsibility provisions. For this purpose, employers may apply a reasonable, good faith interpretation of the term “seasonal worker.”

To learn more about this topic and about when the definition of a seasonal employee is applicable, see our Questions and Answers page.

See the Determining if an Employer is an Applicable Large Employer page on IRS.gov/aca for details about counting full-time and full-time equivalent employees.

Want to look back on past ACA Alerts? View all of our previous alerts in the date categories below.

- September-December 2015

December 22, 2015

IRS Tax Tips Issue Number HCTT 2015-84

Eight Facts about New ACA Information Statements

Many individuals will receive new ACA information statements for the first time in 2016:

Here are eight facts about these forms:

- While the information on these forms may help you complete your tax return, they are not needed to file. You can file your federal tax return even if you have not received one of these statements.

- Form 1095-B, Health Coverage, is used by coverage providers to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore aren’t liable for the individual shared responsibility payment.

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage is used by employers with 50 or more full-time employees, including full-time equivalent employees, in the previous year use, to report the information required about offers of health coverage and enrollment in health coverage for their employees.

- Form 1095-C is also used by employers that offer employer-sponsored self-insured coverage to report information to the IRS and to employees about individuals who have minimum essential coverage under the employer plan and therefore are not liable for the individual shared responsibility payment for the months that they are covered under the plan.

- Individuals who worked for multiple employers that are required to file Form 1095-C may receive a Form 1095-C from each employer.

- The Form 1095-B and 1095-C sent to you may include only the last four digits of your social security number or taxpayer identification number, replacing the first five digits with asterisks or Xs.

- In general, 1095-B and 1095-C must be sent on paper by mail or hand delivered, unless you consent to receive the statement in an electronic format.

- Health coverage providers should furnish a copy of Form 1095-B, to you if you are identified as the “responsible individual.”

November 12, 2015

Bipartisan Budget Act of 2015, Pub. L. No. 114-74, § 604 (Nov. 2, 2015)

Budget Agreement Repeals Health Care Reform’s Automatic Enrollment Provision

The President has signed bipartisan budget legislation that, among other things, repeals health care reform’s automatic enrollment requirement. As background, health care reform amended the Fair Labor Standards Act (FLSA) to require certain large employers to automatically enroll new full-time employees in one of the employer’s group health plans and to continue the enrollment of current employees. (The requirement generally applied to employers that were subject to the FLSA, that had more than 200 full-time employees, and that had one or more health benefit plans.) No effective date had been specified, and 2012 agency guidance had indicated that employers were not required to comply until the issuance of final regulations.

EBIA Comment: Because repeal of automatic enrollment occurred before final regulations were issued, employers were never required to comply with this provision. Some business groups had lobbied for the repeal, arguing that health care reform already requires individuals to have coverage or pay a penalty (under the so-called individual mandate) and that automatic enrollment could negatively impact employees’ eligibility for premium tax credits under the Exchange. The repeal is the only provision of the budget legislation with a direct impact on employer-sponsored group health plans. Other benefits-related provisions affect defined benefit pension plans (e.g., Pension Benefit Guaranty Corporation (PBGC) premium increases, extension of funding stabilization rates, and increased flexibility for plan-specific mortality tables). For more information, see EBIA’s Health Care Reform manual at Section XXXI (“Automatic Enrollment”). See also EBIA’s Self-Insured Health Plans manual at Section XVI.C (“Types of Enrollment”) and EBIA’s Cafeteria Plans manual at Section XVII.J.1 (“Impact of Health Care Reform on Cafeteria Plans: Automatic Enrollment”).

Contributing Editors: EBIA Staff.

October 6, 2015

IRS Tax Tips Issue Number HCTT-2015-52

The Time is Here: Reporting Requirements for Applicable Large Employers

Under the health care law, applicable large employers – those with 50 or more full-time employees, including full-time equivalent employees, in the preceding year – are required to report some information regarding health coverage by filing information returns with the IRS and furnishing statements to full-time employees.

If you’re an ALE, you report information about health coverage you offered to each full-time employee, or to show that you didn’t offer coverage to the full-time employee. This information will help the IRS determine whether an employer shared responsibility payment applies to your organization and is also used in determining the eligibility of employees for the premium tax credit.

Here are some key points about the information reporting requirements under the health care law:

- If you are an ALE, you are required to report certain information to the IRS, as well as to all of your full-time employees, regardless of whether you offer health insurance coverage.

- These ALE reporting requirements are new. Your first information reporting returns are due in 2016 for the year 2015.

- There are new IRS forms that ALEs will use to complete this reporting – Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, and Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns. Form 1094-C is used to report to the IRS summary information and to transmit Forms 1095-C to the IRS. Form 1095-C is used to report information about each full-time employee, and is the form that is furnished to full-time employees.

- If you are an ALE, you are required to furnish each full-time employee with a statement, Form 1095-C, by Jan. 31 of the calendar year following the calendar year to which the information relates. Because Jan. 31, 2016 is a Sunday, the Jan. 31 due date will shift to Feb. 1, 2016. You will meet the requirement if the form is properly addressed and mailed on or before the due date.

- If you are an ALE, you must file the information returns Forms 1094-C and 1095-C with the IRS no later than Feb. 28 – or March 31 if filed electronically – of the year immediately following the calendar year to which the return relates. Because the 2016 deadline falls on a Sunday, the Feb. 28 due date will shift to Feb. 29, 2016.

- Even if you’re an ALE that is not liable for an employer shared responsibility payment because of transition relief, you still have to comply with the information reporting requirements for 2015. You use the reporting forms to communicate to the IRS that you are eligible for transition relief under the employer shared responsibility provisions.

- If you’re an ALE that sponsors a self-insured group health plan for your employees, you also must report information about employees and their dependents who enroll in the coverage, whether or not the employee is a full-time employee.

How to Report

If you file 250 or more information returns during the calendar year, you must file Form 1095-C and Form 1094-C with the IRS electronically.

You will meet your requirement to furnish a statement to your full-time employees if you provide each full-time employee with a copy of the Form 1095-C that you file with the IRS. Statements must be furnished to employees on paper by mail or hand delivered, unless the recipient affirmatively consents to receive the statement in an electronic format.

September 22, 2015

EBA Weekly

Health Care Reform: IRS Releases Final Forms 1094/1095 and Instructions for 2015 With Relief for HRA Reporting and Other Modifications

The IRS has released final Forms 1094 and 1095 and accompanying instructions for 2015. The 2015 forms will be used for mandatory filings first required in early 2016 to enforce Code § 4980H employer penalties…

2015 Form 1094-B; 2015 Form 1095-B; 2015 Form 1094-C; 2015 Form 1095-C; 2015 Instructions for Forms 1094-B and 1095-B; 2015 Instructions for Forms 1094-C and 1095-C (Sept. 16, 2015)

1094-B

1095-B

1094-C

1095-C

B Instructions

C Instructions

- August 2015

August 19, 2015

IRS Tax Tips Issue Number HCTT-2015-50

How the Health Care Law Affects Aggregated Companies

The Affordable Care Act applies an approach to common ownership that also applies for other tax and employee benefit purposes. This longstanding rule generally treats companies that have a common owner or similar relationship as a single employer. These are aggregated companies. The law combines these companies to determine whether they employ at least 50 full-time employees including full-time equivalents.

If the combined employee total meets the threshold, then each separate company is an applicable large employer. Each company – even those that do not individually meet the threshold – is subject to the employer shared responsibility provisions.

These rules for combining related employers do not determine whether a particular company owes an employer shared responsibility payment or the amount of any payment. The IRS will determine payments separately for each company.

For more information about how the employer shared responsibility provisions may affect your company, see our Questions and Answers on IRS.gov/aca. For details about how to determine if you are an applicable large employer, including the aggregation rules, see Determining If You Are an Applicable Large Employer.

August 11, 2015

IRS Tax Tips Issue Number HCTT-2015-48

Reporting Guidance for Applicable Large Employers

Some of the provisions of the health care law apply only to applicable large employers, which is generally those with 50 or more full-time equivalent employees. The law requires ALEs to file information returns in 2016 with the IRS and provide statements to their full-time employees about the health insurance coverage the employer offered.

Monthly Tracking

To prepare for the reporting requirements in 2016, applicable large employers should be tracking information each month of 2015, including:

- Whether you offered full-time employees and their dependents minimum essential coverage that meets the minimum value requirements and is affordable.

- Whether your employees enrolled in the self-insured minimum essential coverage you offered.

Annual Information Reporting

The first statements to employees must be provided by January 31, 2016, and the first information returns to the IRS must be filed by February 28, 2016, or March 31, 2016, if filed electronically.

- ALE members must file Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, and Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, with the IRS annually, no later than February 28 – March 31 if filed electronically – of the year immediately following the calendar year to which the return relates.

- ALE members are also required to provide a statement to each full-time employee that includes the same information provided to the IRS, by January 31 of the calendar year following the calendar year for which the information relates.

- ALEs that file 250 or more information returns during the calendar year must file the returns electronically. ALEs who are self-insured—who sponsor, self-insured group health plans—are subject to the employer information reporting requirements as well as the reporting requirements for providers of minimum essential coverage.

Other Reporting Requirements

For more information, including whether you’re subject to an employer shared responsibility payment, see Publication 5196, Understanding Employer Reporting Requirements of the Health Care Law. For more information, see our Questions and Answers about Information Reporting by Health Coverage Providers and Reporting of Offers of Health Insurance Coverage by Employers.

- July 2015

July 31, 2015

IRS Tax Tips Issue Number HCTT-2015-45

Overview of the Employer Shared Responsibility Provisions

The Affordable Care Act contains specific responsibilities for employers. The size and structure of your workforce – small, large, or part of a group – helps determine what applies to you. Employers with 50 or more full-time equivalent employees will need to file an annual information return reporting whether and what health insurance they offered employees. In addition, they are subject to the Employer Shared Responsibility provisions. All employers that are applicable large employers are subject to the Employer Shared Responsibility provisions, including federal, state, local, and Indian tribal government employers.

An employer’s size is determined by the number of its employees. Generally, if your organization has 50 or more full-time or full-time equivalent employees, you will be considered a large employer. For purposes of this provision, a full-time employee is an individual employed on average at least 30 hours of service per week.

Under the Employer Shared Responsibility provisions, if an applicable large employer does not offer affordable health coverage that provides a minimum level of coverage to their full-time employees and their dependents, the employer may be subject to an Employer Shared Responsibility payment. They must make this payment if at least one of its full-time employees receives a premium tax credit for purchasing individual coverage through the Health Insurance Marketplace.

The Employer Shared Responsibility provisions generally are effective at the beginning of this year. Employers will use information about the number of employees they have and those employees’ hours of service during 2014 to determine if they are an applicable large employer for 2015.

If you are a self-insured employer – that is, an employer who sponsors self-insured group health plans – you are subject to the information reporting requirements for providers of minimum essential coverage whether or not you are an applicable large employer under the employer shared responsibility provisions.

For more information, visit the employer shared responsibility page. For information about transition relief available for employers related to the shared responsibility provision, visit IRS.gov/aca.

July 23, 2015

Employer Penalty Increases

Employer Penalty Increases

On June 29, 2015 President Obama signed into law a new trade bill. Attached to the trade bill was a significant increase for employers who fail to comply with reporting requirements under the Affordable Care Act.

Fines to employers who do not complete filing for individual statements to full-time employees are now $250 per return. A penalty for deliberately not filing/providing reports has now increased to $500 per form.

Get Ready for ACA Reporting

While the Affordable Care Act Reporting is not due until January 31 of 2016, employers should be actively collecting information for this complex 1094 and 1095C reporting.

2015 IRS Forms Released

The IRS recently released the 2015 1094-C & 1095-C reporting forms. These forms are required for employers with 50 or more full time/ full time equivalents. All self-insured employers must also report regardless of their size.

How Does the IRS Use the Forms?

The IRS uses these forms to determine

- If the employer owes a PENALTY under the employer mandate

- Whether or not the employee is eligible for a SUBSIDY from the marketplace

- If an individual has minimum essential coverage in order to avoid a penalty tax under the individual mandate

Employer Plan of Action

Completing the 1094 and 1095C require the employer to collect a significant amount of data. Employers should be assessing what data is needed, where the data is located, and how they will extract their data from their systems to complete reporting.

Important Filing Facts

- Employers between 50-99 Full Time Equivalent Employees are eligible for relief from the employer mandate WILL NEED to complete reporting requirement for calendar year 2015. They must also “certify” that they are eligible for relief.

- Reporting is based upon calendar year regardless of the employer’s plan year

- Required data is reported each month of the calendar year.

We Can Help

Affordable Care Act Compliance & Services, Inc. is a full service Third Party Administrator for the Affordable Care Act. We assist employers with tracking, monitoring, and IRS Reporting.

For more information about our services, email Aurora Keller or contact her at (262)-207-1999 x166. Click here to sign up for our free informational ACA Webinars.

July 21, 2015

IRS Tax Tips Issue Number HCTT-2015-42

Self-Insured Employers Must File Health Coverage Information Returns

Regardless of size, all employers that provide self-insured health coverage to their employees are treated as coverage providers. These employers must file an annual return reporting certain information for each employee they cover.

As coverage providers, these employers must:

- File a Form 1095-B, Health Coverage, with the IRS, accompanied by a Form 1094-B transmittal. Filers of more than 250 Forms 1095-B must e-file. The IRS allows and encourages entities with fewer than 250 forms to e-file.

- Furnish a copy of the 1095-B to the responsible individual – generally the primary insured, employee, parent or uniformed services sponsor. You may electronically furnish the Form 1095-B.

If a provider is an applicable large employer also providing self-insured coverage, it reports covered individuals on Form 1095-C instead of Form 1095-B. Form 1095-C combines reporting for two provisions of the Affordable Care Act for these employers.

The information reporting requirements are first effective for coverage provided in 2015. Thus, health coverage providers will file information returns with the IRS in 2016, and will furnish statements to individuals in 2016, to report coverage information in calendar year 2015.

The information that a provider must report to the IRS includes the following:

- The name, address, and employer identification number of the provider.

- The responsible individual’s name, address, and taxpayer identification number, or date of birth if a TIN is not available. If the responsible individual is not enrolled in the coverage, providers may, but are not required to, report the TIN of the responsible individual.

- The name and TIN, or date of birth if a TIN is not available, of each individual covered under the policy or program and the months for which the individual was enrolled in coverage and entitled to receive benefits.

For more information, see Questions and Answers on Information Reporting by Health Coverage Providers on IRS.gov/aca. Employers who provide self-insured coverage should review Publication 5125, Responsibilities for Health Coverage Providers. Applicable large employers should review Publication 5196, Reporting Requirements for Applicable Large Employers.

July 16, 2015

Increased Penalties in 2016 For Failure toComply With ACA Reporting Requirements

On June 29, 2015 significant penalty increases were signed into law by President Obama. These increases will affect employers and insurers who fail to comply with reporting requirements under the Affordable Care Act.

Failure to comply with ACA Minimum Essential Coverage (MEC) and Large Employer reporting will result in higher penalties beginning in 2016……read more…

- June 2015

June 29, 2015

Affordable Care Act Information Returns (AIR) Application for TCC

Transmitters, Software Developers and Issuers can apply for authorization to electronically file the Affordable Care Act Information Returns (AIR) and to receive an ACA TCC (Transmitter Control Code) beginning today, June 29, 2015.

To assist you with the application process, we have posted the Tutorial for Affordable Care Act (ACA) Application for Transmitter Control Code (TCC) to the Affordable Care Act Information Returns (AIR) Program page on IRS.gov/aca.

For assistance with the ACA Application for Transmitter Control Code (TCC) please contact the ACA Information Return Help Desk toll free at 1-866-937-4130. The ACA Information Return (AIR) Help Desk hours of operation are 6:30 to 6:00 p.m., Monday through Friday, Central Time.

June 25, 2015

King V. Burwell – Affordable Care Act

Background

The case before the U.S. Supreme Court challenged the legality of allowing premium tax credits (or subsidies) when health coverage is purchased through a federal based exchange via the government marketplace. This is an important case because most states did not set up their own state based exchange which does allow for premium tax credits to be used for individuals when they purchase exchange health insurance plans. The ruling has impact because there are an estimated 9.6 million Americans who are enrolled in federal exchange coverage with premium tax credit assistance (subsidies).

Decision

In its decision reached June 25, 2015, Burwell prevailed when the U.S. Supreme Court agreed that premium subsidies should be offered to all Americans regardless of states that do not offer state-run benefits. This ruling allows the continuation of premium tax credits (subsidies) in the Federal Exchange.

Going Forward – What it Means For Employers

It’s important to note that the Employer Shared Responsibility provisions and required IRS reporting is not impacted by this decision. Employers should continue to plan for appropriate resources to comply with the provisions of ACA that impact them. At ACACS, Inc. we will continue to monitor legislative developments and alert you as necessary.

June 24, 2015

IRS Tax Tips Issue Number HCTT-2015-37

Affordable Care Act and Employers: Understanding Affordable and Minimum Value Coverage

In general, under the employer shared responsibility provisions of the Affordable Care Act, an applicable large employer may either offer affordable minimum essential coverage that provides minimum value to its full-time employees and their dependents or potentially owe an employer shared responsibility payment to the IRS.

Here are definitions to help you understand affordable coverage and minimum value coverage.

Affordable coverage: If the lowest cost self-only only health plan is 9.5 percent or less of your full-time employee’s household income then the coverage is considered affordable. Because you likely will not know your employee’s household income, for purposes of the employer shared responsibility provisions, you can determine whether you offered affordable coverage under various safe harbors based on information available to the employer.

Minimum value coverage: An employer-sponsored plan provides minimum value if it covers at least 60 percent of the total allowed cost of benefits that are expected to be incurred under the plan.

Under existing guidance, employers generally must use a minimum value calculator developed by HHS to determine if a plan with standard features provides minimum value. Plans with nonstandard features are required to obtain an actuarial certification for the nonstandard features. The guidance also describes certain safe harbor plan designs that will satisfy minimum value.

For more information, visit the Affordable Care Act Tax Provisions for Employers pages on IRS.gov/aca.

June 10, 2015

IRS Tax Tips Issue Number HCTT-2015-35

The Health Care Law and Employers: The ACA Basics for Applicable Large Employers

Some of the provisions of the Affordable Care Act only affect your organization if it’s an applicable large employer. An applicable large employer is generally one with 50 or more full-time employees, including full-time equivalent employees.

- Applicable large employers have annual reporting responsibilities; you will need to provide the IRS and employees information returns concerning whether and what health insurance you offer to your full-time employees.

- If you’re an applicable large employer that provides self-insured health coverage to your employees, you must file an annual return reporting certain information for each employee you cover.

- You may have to make an employer shared responsibility payment if you do not offer adequate, affordable coverage to your full-time employees, and one or more of those employees get a premium tax credit. Learn more about the employer shared responsibility provision.

- You may be required to report the value of the health insurance coverage you provided to each employee on their Form W-2.

- If you’re an applicable large employer with exactly 50 employees, you can purchase affordable insurance through the Small Business Health Options Program (SHOP).

For more information, see the Affordable Care Act Tax Provisions for Employers page on IRS.gov/aca.

June 3, 2015

IRS Tax Tips Issue Number HCTT-2015-34

ACA and Employers: How Seasonal Workers Affect Your ALE Status

When determining if your organization is an applicable large employer, you must measure your workforce by counting all your employees. However, there is an exception for seasonal workers.

If an employer’s workforce exceeds 50 full-time employees for 120 days or fewer during a calendar year, and the employees in excess of 50 who were employed during that period of no more than 120 days were seasonal workers, the employer is not considered an applicable large employer.

A seasonal worker for this purpose is an employee who performs labor or services on a seasonal basis. For example, retail workers employed exclusively during holiday seasons are seasonal workers.

The terms seasonal worker and seasonal employee are both used in the employer shared responsibility provisions, but in two different contexts. Only the term seasonal worker is relevant for determining whether an employer is an applicable large employer subject to the employer shared responsibility provisions. For this purpose, employers may apply a reasonable, good faith interpretation of the term seasonal worker.

To learn more about this topic and about when the definition of a seasonal employee is applicable, see the Questions and Answers page.

See the Determining if an Employer is an Applicable Large Employer page on IRS.gov/aca for details about counting full-time and full-time equivalent employees.

- May 2015

May 28, 2015

IRS Tax Tips Issue Number HCTT-2015-33

ACA Information for Employers Counting Full-time and Full-time Equivalent Employees

For the purposes of the Affordable Care Act, employers average their number of employees across the months in the year to see whether they will be an applicable large employer.

To determine if your organization is an applicable large employer for a year, count your organization’s full-time employees and full-time equivalent employees for each month of the prior year. If you are a member of an aggregated group, count the full-time employees and full-time equivalent employees of all members of the group for each month of the prior year. Then average the numbers for the year. Employers with 50 or more full-time equivalent employees are applicable large employers and will need to file an annual information return reporting whether and what health insurance they offered employees. In addition, they are subject to the Employer Shared Responsibility provisions.

In general:

- A full-time employee is an employee who is employed on average, per month, at least 30 hours of service per week, or at least 130 hours of service in a calendar month.

- A full-time equivalent employee is a combination of employees, each of whom individually is not a full-time employee, but who, in combination, are equivalent to a full-time employee.

- An aggregated group is commonly owned or otherwise related or affiliated employers, which must combine their employees to determine their workforce size.

There are many additional rules on determining who is a full-time employee, including what counts as hours of service…read more

May 22, 2015

IRS Provides Further Guidance on ACA Reporting

The IRS has provided new and updated Q&A guidance on the reporting requirements for applicable large employers (ALE) under Code Section 6055 and 6056. All ALE’s must file forms 1094 and 1095 to provide information to the IRS and plan participants about health coverage provided in the prior year. The first IRS reports are due by January 31, 2016. The forms are used by the IRS to enforce Code Section 4980H employer penalties, as well as individual mandate and tax credit eligibility rules.

New and Updated Guidance

New and updated guidance consists of an updated Q&A document covering basic reporting requirements and a new Q&A document addressing more specific issues that may arise while completing Forms 1094 and 1095…read more

May 6, 2015

The Affordable Care Act and Employers: Why Workforce Size Matters

The Affordable Care Act contains several tax provisions that affect employers. Under the ACA, the size and structure of a workforce – small, or large – helps determine which parts of the law apply to which employers.

The number of employees an employer had during the prior year determines whether it is an applicable large employer for the current year. This is important because two provisions of the Affordable Care Act apply only to applicable large employers. These are the employer shared responsibility provision and the employer information reporting provisions for offers of minimum essential coverage.

An employer’s size is determined by the number of its employees.

- An employer with 50 or more full-time employees or full-time equivalents is considered an applicable large employer – also known as an ALE – under the ACA.

- For purposes of the employer shared responsibility provision, the number of employees a business had during the prior year determines whether it is an ALE the current year. Employers make this calculation by averaging the number of employees they had throughout the year, which takes into account workforce fluctuations many employers experience.

- Employers with fewer than 50 full-time or full-time equivalent employees are not applicable large employers.

- Calculating the number of employees is especially important for employers that have close to 50 employees or whose work force fluctuates during the year.

To determine its workforce size for a year, an employer adds the total number of full-time employees for each month of the prior calendar year to the total number of full-time equivalent employees for each calendar month of the prior calendar year. The employer then divides that combined total by 12.…read more

May 4, 2015

IRS Releases Publication 5215 How to Report in 2016: Form 1095-B

The IRS Releases Publication 5215: How to Report Form 1095-B in 2016. For small self-insured employers and health insurance carriers. (Applicable large employers should refer to Publication 5196 regarding Section 6056.)

ACA Alert – New Frequently Asked Questions (FAQs) regarding SBC Implementation and Wellness Programs

DOL publishes new FAQs addressing SBC Implementation (Part XXIV) and Wellness Programs (Part XXV). FAQs about Affordable Care Act Implementation:

(Part XXIIV) SBC Implementation

(Part XXV) Wellness Programs

…read more

- February-April 2015

April 20, 2015

IRS Fact Sheet on Information Reporting by Providers of Minimum Essential Coverage

-

- Any person, including health insurance issuers, self-insured employers, government agencies, and other entities, that provide minimum essential coverage to an individual during a calendar year must report certain information to the IRS.

- Providers of minimum essential coverage also must furnish, for each covered individual, a statement that includes the same information provided to the IRS.

- Providers that file 250 or more section 6055 information returns during the calendar year must file the returns electronically. See How to File Electronically, below.

- The information furnished and reported is used by individuals and the IRS to verify the months, if any, in which individuals were covered by minimum essential coverage and, therefore, have satisfied the individual shared responsibility requirement of section 5000A of the Internal Revenue Code.

- Minimum essential coverage is defined in Internal Revenue Code section 5000A(f) and the regulations under that section.

…read more.

March 3, 2015

The Centers for Medicare & Medicaid Services announced Special Enrollment Period (SEP) for tax season. Eligible consumers* have from March 15 through April 30, 2015 to enroll in coverage. For individuals and families who were unaware or didn’t understand the implications of this new requirement to enroll in 2015 health related coverage…read more.

February 17, 2015

The IRS has just released final forms for reporting under IRS Code Section 6055 and 6056. All companies with 50+ full-time equivalent employees, will need to report to the IRS in 2016. If you qualify as a large employer you should be tracking employees monthly, beginning January 1, 2015, to prepare for 2016 reporting. …read more.

- 2014

February 10, 2014

On February 10, 2014, the IRS and the Treasury Department issued final regulations on the Employer Shared Responsibility provisions under section 4980H of the Internal Revenue Code.

For 2015 and after, employers employing at least 50 full-time employees or a combination of full-time and part-time employees that is equivalent to 50 full-time employees, will be subject to the Employer Shared Responsibility provisions under section 4980H of the Internal Revenue Code. As defined by the statute, a full-time employee is an individual employed on average at least 30 hours of service per week. An employer that meets the 50 full-time employee threshold is referred to as an applicable large employer.

Under the Employer Shared Responsibility provisions, if these employers do not offer affordable health coverage that provides a minimum level of coverage to their full-time employees (and their dependents), the employer may be subject to a penalty (or fine) if at least one of its full-time employees receives a premium tax credit (subsidy) for purchasing individual coverage on the new Health Insurance Marketplace Exchange.

To be subject to the Employer Shared Responsibility provisions for a calendar year, an employer must have employed (during the previous calendar year) at least 50 full-time employers or a combination of full-time and part-time employees that equals at least 50.

What employers are affected and when?

The Employer Shared Responsibility provisions generally are not effective until January 1, 2015, meaning that no employer penalties or fines will be assessed for 2014 (2013-45). Employers will use information about the number of employees they employ and their hours of service during 2014 to determine whether they employ enough employees to be an applicable large employer for 2015.

All employers that are applicable large employers are subject to the Employer Shared Responsibility provisions, including for-profit, non-profit, and government entity employers.

Common Ownership

If two or more companies have a common owner or are otherwise related, they are combined for purposes of determining whether they employ enough employees to be subject to the Employer Shared Responsibility provisions. Refer to Internal Revenue Code 414(b) for additional guidance on common ownership and controlled group status.

Transitional Relief Available

Transitional relief is available to applicable large employers who qualify under the following conditions and circumstances;

Determining Applicable Large Employer Status

Rather than using the full twelve months of 2014 to measure whether an employer has 50 full-time employees (or equivalents), an employer may measure during any consecutive six-month period (as chosen by the employer) during 2014.

Employers with at least 50 but fewer than 100 full-time employees

For employers with fewer than 100 full-time employees (including full-time equivalents) in 2014, that meet the conditions described below, can apply to the IRS for transitional relief which allows for no Employer Shared Responsibility payment under section 4980H(a) or (b) for any calendar month during 2015. For employers with non-calendar year health plans, this applies to any calendar month during the 2015 plan year, including months during the 2015 plan year that fall in 2016. In order to be eligible for the relief, an employer must certify, among others, that it meets the following conditions:

- Limited Workforce Size – The employer must employ on average at least 50 full-time employees (including full-time equivalents) but fewer than 100 full-time employees (including full-time equivalents) on business days during 2014.

- Maintenance of Workforce and Aggregate Hours of Service – During the period beginning on February 9th, 2014 and ending on December 31, 2014, the employer may not reduce the size of its workforce or the overall hours of service of its employees in order to qualify for the transition relief. However, an employer that reduces workforce size or overall hours of service for bona fide business reasons is still eligible for the relief.

- Maintenance of Previously Offered Health Coverage – During the period beginning on February 9th, 2014 and ending on December 31, 2015, (or, for employers with non-calendar year plans, ending on the last day of the 2015 plan year), the employer does not eliminate or materially reduce the health coverage it offered to employees as of February 9th, 2014.

Employers with more than 100 full-time employees

For 2015 (and for employers with non-calendar year plans, any calendar months during the 2015 plan year that fall in 2016), an employer that employs at least 100 full-time employees (including full-time equivalents) in 2014, will be allowed relief in offering health coverage to 70% of full-time eligible employees rather than the required 95% as stated in the original regulation. This transitional relief is only available to applicable large employers with more than 100 employees for the 2015 plan year.

- 2013

October 28, 2013

On Monday October 28, 2013 the Administration granted a six-week extension until March 31 for Americans to sign up for coverage next year to avoid the new tax penalties.

Under the change, people who sign up by the end of open enrollment season on March 31 will not face a penalty. The previous rule identified that to avoid the penalty, Americans had to sign up by the middle of February to guarantee their coverage would take effect on March 1. This extension has been granted for 2014 only.

October 21, 2013

PPACA penalty deadline could move The Obama administration conceded it might consider tweaking at least one Patient Protection and Affordable Care Act exchange application deadline.

Jay Carney, the White House press secretary, said during a press briefing today that the U.S. Department of Health and Human Services might be working on a fix for the conflict between the PPACA individual health insurance mandate penalty and the end of the open enrollment period. Click here to read more.

September 11, 2013

The DOL has further clarified in a FAQ that employers will not be assessed penalties for failing to provide employees with notice about the Affordable Care Act new Health Insurance Marketplace.

While the FAQ identifies that the penalties will not be assessed to employers who do not provide a written notice by October 1, 2013, the FAQ does go on to discuss that the employer should provide the notice.

We have contacted the DOL for further guidance on whether this FAQ also applies to new hire notice requirements after October 1, 2013.

The Department of Labor’s Employee Benefits Security Administration updated its website with a FAQ on Notice of Coverage Options under the Affordable Care Act.

July 3rd, 2013

The Treasury Department announced a one year delay in the Employer Mandate provision of the Affordable Care Act. This delay, (until January 1st, 2015), affords large employers (with more than 50 employees) a reprieve from the penalties associated with not offering group health insurance at all or not offering “affordable” health insurance for employees. Click here to see Treasury Department Notice.

The delay also affects the required employer reporting (IRC 6055 and 6056) to be re-evaluated by the IRS. We expect revised guidance on mandated reporting requirements later this summer.

Our Recommendation

We recommend, for our large employer clients, to continue working with your Account Executive and Management Team to evaluate necessary plan changes in preparation of the mandates effective in 2015. We are approaching this delay as an opportunity to “test run” in 2014 without penalties.

Affordable Care Act Deadlines

January 1, 2015

The Large Employer Mandate (pay or play rules) and associated IRS reporting begins for the first plan year starting on or after 1/1/15 for employers with 100 or more FTEs.

- The employer must offer coverage to at least 70% of its full-time employees in 2015.

- The employer must offer coverage to at least 95% of its full-time employees in 2016 and thereafter.

Small plans must obtain a health plan identifier (HPID) and begin reporting health insurance coverage.

January 1, 2016

The Large Employer Mandate (pay or play rules) begins for employers of between 50 and 99 employees for the first plan year starting on or after January 1, 2016 provided an employer:

- Did not reduce employee hours or its workforce to take advantage of transitional relief (between February 9th, 2014 and December 31st, 2014).

- The employer does not eliminate or materially change the health coverage (by more than 5% in premiums or benefit coverage) from the plan they had in place as of February 9th, 2014.

- The employer “certifies” with the IRS that it has complied with these requirements.

2018

The Cadillac tax takes effect

Employer Penalty Increases

Employer Penalty Increases